Bitcoin and it's impact on developing nations.

In Brief:

- Bitcoin and government money

- The role of Bitcoin in developing worlds

- How exactly blockchain helps developing worlds

- El Salvador Bitcoin experiment

“The inevitable failures of fiat currency create the success of bitcoin.” — Unknown

Bitcoin and government money

Until the advent of Bitcoin in 2009, there was no credible alternative to the currencies that governments forced people to use.

They have had a virtual monopoly on money, and this age of human history could potentially be coming to an end in the coming decades. Bitcoin and cryptocurrencies offer the world the possibility of separating state and money in the same manner that church and state were.

When a good is in high demand and has only one supply, the market can be manipulated in just about any manner. The supplier can raise prices because consumers will have no other less expensive option, and they can diminish the value of their goods because there is no competition who can supply a higher quality alternative.

The same holds true with money. It is no different from any other in-demand good or commodity. Consumer satisfaction rises as a result of supplier competition. Until bitcoin, there has been no competition to government money.

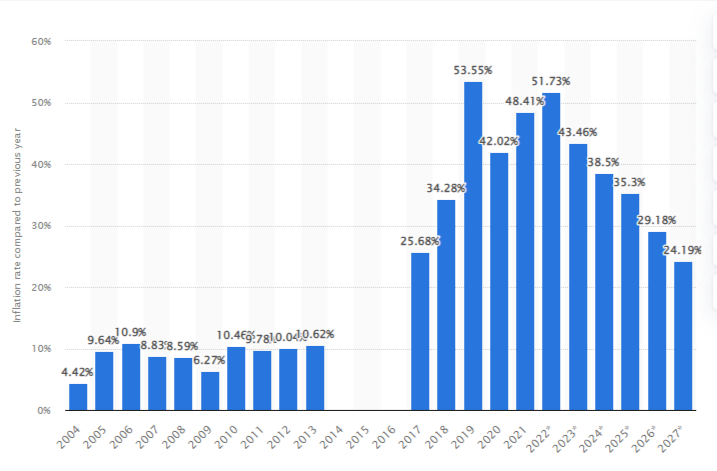

Venezuela, Zimbabwe, Argentina are only a few examples of countries dealing with the problem of hyperinflation.

Hyperinflation effectively brings a country’s entire economy to a standstill. It demonstrates how critical the soundness of a country’s currency needs to be.

The Swift Adoption of Bitcoin in Developing Worlds

Most people in developing nations regard Bitcoin as a powerful development instrument. This is because virtual currency functions as digital money via which users may deal over the internet. While many individuals in the developing countries are impoverished, they can access and utilize the internet. As a result, they may use their smartphones to connect to the Bitcoin network.

Exchanging money through cryptocurrency exchanges is also less expensive and more accessible for people in underdeveloped nations. This helps to explain the high rate of Bitcoin acceptance in certain areas.

Most people with middle-class incomes can afford to trade Bitcoin in undeveloped countries.

Argentina has the world’s sixth highest rate of cryptocurrency adoption. According to estimates, by 2021, 21% of Argentines will have used or owned cryptocurrency.

“There are 2 types of people, those who know they need bitcoin, and those who don’t know it yet”.Changpeng Zhao, CEO of Binance

Most developing countries have been subjected to decades of restrictive banking laws and poor infrastructure.

Argentina, for example, limits foreign exchange to $200 per month, which magnifies hyperinflation and drives up crypto use.

Some people and small businesses in underdeveloped countries lack convenient access to bank accounts.

Inaccessibility to banking services has also prevented them from participating in e-commerce.

“The local environment is pushing people to protect their capital in cryptocurrencies and so we see growth speeding up, throughout Latin America the growth potential is enormous, it is an avalanche that won’t be stopped.”Mauro Liberman, 39

To summarize, cryptocurrencies quickly address some concerns that frequently impact national currencies, such as:

- Fast-moving exchange rates

- Hyperinflation

- Inefficient, inaccessible and expensive banking systems

- Strict regulation and financial restrictions

Blockchain serves to bank the unbanked, fight inflation and corruption.

Without a doubt, Bitcoin offers a variety of real-world applications. However, the bulk of enterprises and people in underdeveloped countries utilize it as a form of payment and a store of wealth.

Numerous shops now accept Bitcoin and other cryptocurrencies as payment for goods and services in their stores.

The advantages of immutability and decentralization have been felt in developed countries. These benefits, however, are significantly exaggerated and more visible in developing countries, particularly those where annual inflation rates of 60–70 percent are becoming more prevalent.

The limitations of traditional banking institutions in underdeveloped countries make them ideal for Bitcoin adoption.

But not all stories shine such a bright light on Bitcoin and crypto adoption.

El Salvador Bitcoin Experiment

El Salvador declared Bitcoin legal tender in September 2021.

Many people were excited to check out the technology since they heard it would cut costs and speed up payments.

After a few days of resolving technical difficulties, small business owners were up and running, receiving Bitcoin payments from clients.

But their list of Bitcoin complaints grew long: the only Bitcoin ATM was too far away, the government helpline was slow, and the price was too volatile.

El Salvador’s national Bitcoin wallet, known as Chivo, was developed to encourage this massive change, but 6 months later, the majority of users have already abandoned it.

Chivo’s initial release was tarnished by functional and security flaws.

Though approximately half of the Salvadorans polled have downloaded Chivo to date, with 40% of those downloads occurring in September 2021, the National Bureau of Economic Research discovered that approximately 61 percent of those had abandoned it once the $30 sign-up incentive was withdrawn.

According to El Salvador’s Central Bank, only 1.6 percent of total remittances were received in bitcoins via digital wallets in February 2022.

Few of Chivo’s transactions involve commercial or critical use cases. The average user saw no reason to continue using Bitcoin instead of dollars.

However, even having dollars in Chivo may not be as safe as it appears. On April 27, local media publication El Faro revealed that customers’ Chivo wallets do not contain US dollars, but rather stable-dollar coins backed by either the Salvadoran government or a private enterprise.

Conclusion

The majority of the world’s most powerful countries, 44 in total, tied the value of their currency to the US dollar as a result of the Bretton Woods agreement in 1944. This established the United States as the world’s main financial power.

The US dollar was safe and held its value at this time because it was backed by and redeemed for gold. When this occurred, foreign central banks were able to redeem one ounce of gold for $35 USD at a set rate. As of this writing, a single ounce of gold is worth $1,783.

By withdrawing the US dollar’s gold backing in 1971, President Nixon compelled the bulk of the world’s population to use currencies that were then backed by nothing. The world is currently in around $255 trillion dollars of debt.

Over the decades following, developing nations will be the main testing ground for Bitcoins adoption.

It might only be a matter of time before this global system implodes. If that happens, more people will use Bitcoin, and it will be of enormous value to humanity.

Bitcoin is projected to withstand all recessions, especially given that it was built on the heels of one.